How To Set Stop Loss On Metatrader 5

Bones Principles

Before you proceed to study the trade functions of the platform, you lot must accept a clear understanding of the basic terms: order, deal and position.

- An order is an didactics given to a broker to buy or sell a financial musical instrument. There are two chief types of orders: Market and Awaiting. In addition, there are special Accept Profit and Finish Loss levels.

- A deal is the commercial commutation (buying or selling) of a financial security. Buying is executed at the demand toll (Ask), and Sell is performed at the supply price (Bid). A deal tin can be opened equally a result of market order execution or awaiting lodge triggering. Note that in some cases, execution of an order tin can event in several deals.

- A position is a trade obligation, i.e. the number of bought or sold contracts of a financial musical instrument. A long position is financial security bought expecting the security price go higher. A short position is an obligation to supply a security expecting the price will fall in future.

Interrelation of orders, deals and positions

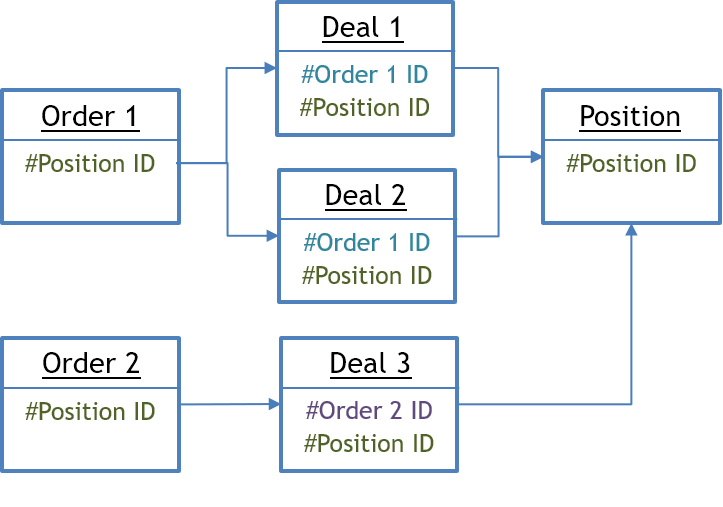

The platform allows y'all to easily track how a position was opened or how a deal was performed. Each trading operation has its unique ID chosen a "ticket". Each society and bargain receive a ticket relating to their relevant position. Each deal receives a ticket of an order, past which it was concluded.

If a position was affected past multiple deals, for instance in the case of a partial closing or increasing volumes, each of the deals feature the position'due south ticket. This makes it like shooting fish in a barrel to rail the entire history of the position equally a whole.

If trading operations are sent to an exchange or a liquidity provider, they additionally feature an ID from an external system. This allows boosted tracking of the interrelation of operations away from the platform.

A General Scheme of Trading Operations

- From the trading platform, an club is sent to a broker to execute a bargain with the specified parameters;

- The correctness of an order is checked on the server (correctness of prices, availability of funds on the account, etc.);

- Orders that have passed the check look to be processed on the trade server. Then the order can be:

- executed (in 1 of automatic execution modes or past a dealer)

- canceled upon expiry

- rejected (due east.g. when coin is not enough or at that place is no suiting offer in the marketplace; or rejected by the dealer)

- canceled by a trader;

- A deal is the result of the execution of a market order or triggering of a awaiting guild;

- If in that location are no positions for a symbol, conclusion of a deal results in opening of a position. If in that location is a position for the symbol, the deal tin increase or reduce the position volume, close the position or contrary information technology.

Position Accounting System #

Two position bookkeeping systems are supported in the trading platform: Netting and Hedging. The system used depends on the account and is ready by the broker.

Netting System #

With this arrangement, you can have but one common position for a symbol at the same time:

- If in that location is an open position for a symbol, executing a deal in the same direction increases the volume of this position.

- If a deal is executed in the contrary direction, the volume of the existing position can exist decreased, the position can be closed (when the bargain volume is equal to the position volume) or reversed (if the volume of the reverse bargain is greater than the current position).

It does not matter, what has caused the opposite deal — an executed market place order or a triggered awaiting club.

The below example shows execution of two EURUSD Purchase bargain 0.5 lots each:

Execution of both deals resulted in one common position of 1 lot.

Hedging System #

With this system, you can have multiple open up positions of ane and the same symbol, including opposite positions.

If yous have an open position for a symbol, and execute a new deal (or a pending club triggers), a new position is additionally opened. Your electric current position does not alter.

The below example shows execution of two EURUSD Buy deal 0.5 lots each:

Execution of these deals resulted in opening two split up positions.

Bear upon of the Arrangement Selected

Depending on the position accounting system, some of the platform functions may accept different behavior:

- Stop Loss and Have Profit inheritance rules change.

- To close a position in the netting system, you should perform an opposite trading operation for the same symbol and the same volume. To shut a position in the hedging organisation, explicitly select the "Close Position" command in the context menu of the position.

- A position cannot exist reversed in the hedging organization. In this instance, the current position is airtight and a new i with the remaining volume is opened.

- In the hedging system, a new status for margin calculation is available — Hedged margin.

Types of Orders #

The trading platform allows to prepare and consequence requests for the broker to execute trading operations. In add-on, the platform allows to control and manage open up positions. Several types of trading orders are used for these purposes. An social club is a trader's instruction to the banker to perform a trade operation. In the platform, orders are divided into two master types: market and pending. In add-on, there are special End Loss and Have Profit orders.

Marketplace Order #

A market guild is an instruction given to a brokerage company to buy or sell a fiscal musical instrument. Execution of this guild results in the execution of a deal. The price at which the deal is executed is determined by the type of execution that depends on the symbol type. By and large, a security is bought at the Ask price and sold at the Bid price.

Pending Order #

A pending order is the trader's instruction to a brokerage visitor to purchase or sell a security in time to come under pre-defined weather. The following types of pending orders are available:

- Purchase Limit — a merchandise request to buy at the Enquire cost that is equal to or less than that specified in the order. The current toll level is college than the value specified in the order. Ordinarily this society is placed in apprehension of that the security price will fall to a certain level and so volition increase;

- Buy Cease — a merchandise society to buy at the "Ask" toll equal to or greater than the i specified in the order. The current price level is lower than the value specified in the club. Usually this order is placed in the anticipation that the price will attain a certain level and will proceed to abound;

- Sell Limit — a merchandise society to sell at the "Bid" cost equal to or greater than the ane specified in the order. The current price level is lower than the value specified in the order. Commonly this order is placed in apprehension of that the security toll volition increase to a certain level and volition fall then;

- Sell Cease — a merchandise order to sell at the "Bid" price equal to or less than the one specified in the social club. The current toll level is higher than the value in the lodge. Usually this order is placed in anticipation of that the security price will achieve a sure level and volition keep on falling.

- Purchase Stop Limit — this type is the combination of the first 2 types, being a stop order to identify a Buy Limit order. As soon equally the future Enquire price reaches the finish-level indicated in the society (the Price field), a Buy Limit order will be placed at the level, specified in End Limit cost field. A stop level is set above the current Ask toll, while Stop Limit price is set below the stop level.

- Sell Stop Limit — this order is a stop order to place a Sell Limit society. As shortly every bit the future Bid price reaches the finish-level indicated in the order (the Price field), a Sell Limit club will be placed at the level, specified in Stop Limit price field. A stop level is set beneath the current Bid price, while Stop Limit price is set to a higher place the cease level.

- For symbols with Exchange Stocks, Exchange Futures and Futures Forts calculation modes, all types of pending orders are triggered according to the rules of the exchange where trading is performed. Usually, Concluding cost (price of the terminal performed transaction) is applied. In other words, an order triggers when the Concluding toll touches the price specified in the order. But note that buying or selling equally a consequence of triggering of an order is e'er performed by the Ask and Bid prices respectively.

- In the "Exchange execution" mode, the price specified when placing limit orders is not verified. It tin can exist specified above the current Ask price (for the Purchase Limit orders) and beneath the current Bid price (for the Sell Limit orders). When placing an order with such a toll, it triggers virtually immediately and turns into a marketplace i. Notwithstanding, unlike market orders where a trader agrees to perform a deal by a not-specified electric current marketplace price, a awaiting order volition be executed at a toll no worse than the one specified.

- If during pending order activation the corresponding marketplace operation cannot exist executed (for example, the free margin on the account is non enough), the pending lodge will be canceled and moved to history with the "Rejected" status.

| | — current market place state | | — forecast |

| | — current toll | | — club toll |

| | — toll, reaching which a pending order will exist placed | ||

| | — expected growth | | — expected fall |

Take Profit #

The Have Profit society is intended for gaining the turn a profit when the security toll reaches a certain level. Execution of this guild results in the complete closing of the unabridged position. Information technology is always connected to an open up position or a pending club. The order can be requested just together with a market or a pending social club. This order condition for long positions is checked using the Bid toll (the gild is ever prepare above the electric current Bid cost), and the Ask price is used for curt positions (the guild is always fix below the current Ask cost).

Stop Loss #

This guild is used for minimizing losses if the security price moves the wrong direction. If the security price reaches this level, the entire position is closed automatically. Such orders are always associated with an open position or a pending club. They tin be requested only together with a market or a pending society. This order condition for long positions is checked using the Bid price (the social club is always prepare below the electric current Bid price), and the Ask toll is used for brusk positions (the order is always set above the current Ask price).

If during Take Turn a profit or Stop Loss activation the respective market performance cannot be executed (for case, it is rejected by the commutation), the gild volition not be deleted. It will trigger again at the next tick corresponding to the order activation weather.

Rules of Stop Loss and Accept Profit inheritance (netting): #

- When a position volume is increased or the position is reversed, Take Profit and Finish Loss are placed according to its latest club (market or triggered pending order). In other words, finish levels in each subsequent order of the same position replace previous ones. If goose egg values are specified in the order, Stop Loss and Take Profit of a position volition be deleted.

- If a position is partially closed, Stop Loss and Accept Profit are non changed by the new club.

- If a position is fully closed, the Terminate Loss and Have Profit levels are deleted, considering they are associated with an open position and cannot exist without it.

- When a trade operation is executed for a symbol, for which there is a position, the current Finish Loss and Take Profit of the open position are automatically inserted in the order placing window. This is aimed to prevent accidental deletion of current stop orders.

- During one click trading operation (from a panel on the nautical chart or from the Market Watch) for the symbol, for which there is a position, the current values of Stop Loss and Take Profit are non changed.

- On the OTC markets (Forex, Futures), when a position is moved to the next trading mean solar day (the swap), including swap through re-opening, the levels of Stop Loss and Take Profit remain unchanged.

- On the exchange market, when a position is moved to the next trading 24-hour interval (the swap), besides as when moved to another account or during commitment, the levels of Stop Loss and Take Profit are reset.

Stop Loss and Take Profit inheritance rule (hedging):

- If a position is partially airtight, Stop Loss and Take Turn a profit are non changed by the new gild.

- If a position is fully closed, the Stop Loss and Take Profit levels are deleted, because they are associated with an open position and cannot exist without information technology.

- During ane click trading operation (from a console on the nautical chart or Depth of Marketplace), the Finish Loss and Take Profit levels are not set up.

These rules apply both when trading manually and when placing orders from Good Advisors (MQL5 programs).

- Trailing Stop tin can be used to make Terminate Loss follow the price automatically.

- Activation of Have Profit or Terminate Loss results in the complete closing of the unabridged position.

- For symbols with Exchange Stocks, Exchange Futures and Futures Forts calculation modes, Stop Loss and Take Profit orders are triggered according to the rules of the exchange where trading is performed. Unremarkably, Last price (price of the last performed transaction) is applied. In other words, a cease-guild triggers when the Last cost touches the specified price. Notwithstanding note that buying or selling as a result of activation of a stop-order is always performed by the Bid and Ask prices.

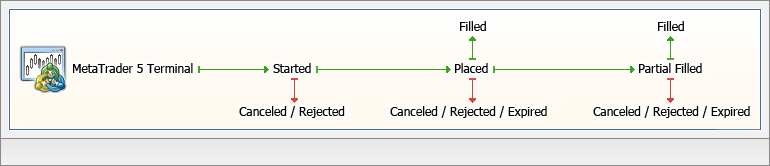

Trailing Stop #

Stop Loss is used for minimizing losses if the security price moves the wrong direction. Once a position becomes assisting, its Stop Loss tin can be manually moved to a intermission-even level. Trailing Stop automates this process. This tool is especially useful during a strong unidirectional cost motion or when it is impossible to monitor the market continuously for some reason.

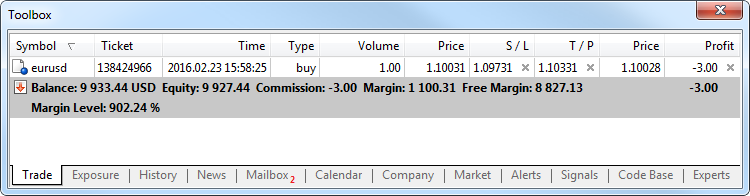

Trailing Cease is always associated with an open position or a pending lodge. Information technology is executed in the trading platform rather than on the server like Stop Loss. To fix a Trailing Finish, select "Trailing End" in the context menu of a position or an order in the "Trading" tab:

Select a necessary value of a distance between the Terminate Loss level and the current price.

For each open position or awaiting order simply one Trailing Stop can be set.

Scheme of Trailing Stop Operation

- When new quotes arrive, the platform checks whether an open up position is profitable.

- Every bit soon as the profit in points becomes equal to or larger than the indicated level, an automatic command is generated to identify a End Loss at the indicated distance from the current price.

- If price moves increasing the position profit, "Cease Loss" automatically moves together with the cost.

- Otherwise, the order is non modified. Thus, the profit of a trading position is stock-still automatically.

- If a Cease Loss has been set for the position, it also follows the cost when the position turn a profit increases and remains unchanged if it decreases.

- When a pending order triggers, the abaft terminate of the electric current position for the same symbol is overwritten with the trailing stop specified for the order.

- If a deal made equally a result of triggering of a pending order has the opposite direction to the electric current position for the symbol and has less or equal volume, then the trailing stop is non overwritten.

With each automatic modification of Stop Loss an entry is added to the journal.

To disable Abaft Terminate, set the "![]() None" parameter in the control menu. The "

None" parameter in the control menu. The "![]() Delete All" command disables Trailing Stops of all open positions and awaiting orders.

Delete All" command disables Trailing Stops of all open positions and awaiting orders.

- The Trailing Stop is executed in the trading platform rather than on the server (like Terminate Loss or Take Turn a profit). This is why it volition not work, dissimilar the above orders, if the platform is off. In this instance, only the Stop Loss level ready past the Abaft Stop will trigger.

- For i position, Trailing Stop cannot occur more one time every ten seconds.

- If there are several positions with Trailing Stop at a single symbol, the Trailing Stop is processed in a specific way. When a tick arrives, only a Trailing Terminate of the last opened position is candy. If notwithstanding another tick arrives for the aforementioned symbol within 10 seconds, a Trailing Terminate of the side by side position (opened 2nd concluding) is processed. If the next tick arrives later on than 10 seconds, a Abaft Terminate of the position opened concluding is candy again.

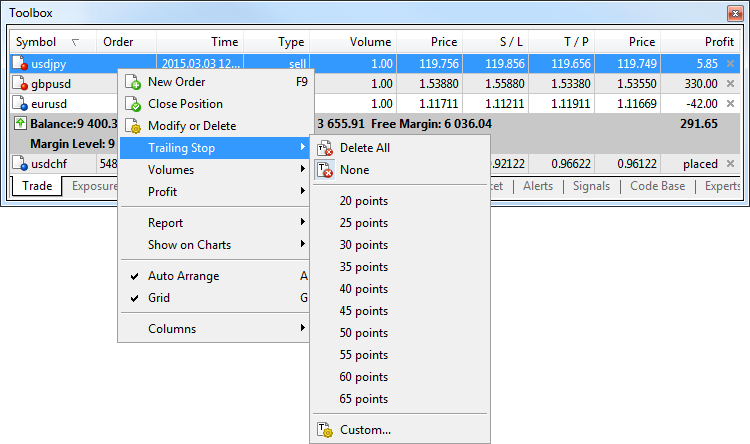

State of Orders #

After an order has been formed and sent to a trade server, information technology tin can undergo the following stages:

- Started — the order correctness has been checked, only it hasn't been yet accepted past the banker;

- Placed — a dealer has accepted the order;

- Partially filled — the social club is filled partially;

- Filled — the entire order is filled;

- Canceled — the order is canceled by the client;

- Rejected — the order is rejected by a dealer;

- Expired — the order is canceled due to its expiration.

You can view the land of orders on the "History" tab in field "State". The state of awaiting orders that haven't triggered yet can be viewed on the "Merchandise" tab.

Types of Execution #

Four social club execution modes are available in the trading platform:

- Instant Execution

In this mode, an order is executed at the price offered to a banker. When sending an order to be executed, the platform automatically adds the electric current prices to the order. If the broker accepts the prices, the lodge is executed. If the broker does not accept the requested price, a "Requote" is sent — the broker returns prices, at which this order can be executed. - Asking Execution

In this style, a market place order is executed at the toll previously received from a banker. Prices for a certain market order are requested from the banker earlier the guild is sent. After the prices accept been received, order execution at the given price can be either confirmed or rejected. - Market Execution

In this guild execution fashion, a broker makes a decision well-nigh the guild execution price without any boosted discussion with a trader. Sending an order in such a mode means advance consent to its execution at this price. - Exchange Execution

In this mode, trade operations conducted in the trading platform are sent to an external trading arrangement (exchange). Trade operations are executed at the prices of electric current market offers.

Execution way for each security is divers past the brokerage visitor.

Fill up Policy #

In addition to common rules of gild execution ready past a broker, a trader can indicate additional weather in the "Make full Policy" field of the order placing window:

- Fill or Kill (FOK)

This fill up policy means that an order can be filled only in the specified volume. If the necessary amount of a financial instrument is currently unavailable in the marketplace, the order will not be executed. The required book tin exist filled by several offers available in the market place at the moment. - Firsthand or Cancel (IOC)

In this case a trader agrees to execute a bargain with the volume maximally bachelor in the market within that indicated in the society. In case the order cannot exist filled completely, the bachelor volume of the order will be filled, and the remaining volume volition exist canceled. The possibility of using IOC orders is adamant on the trade server. - Return

This policy is only used for market (Buy and Sell), limit and stop limit orders. If filled partially, an order with the remaining volume is non canceled, and is processed further. For market orders, the Return policy is used only in the Exchange Execution fashion, while for limit and stop limit ones, information technology is practical in the Market Execution and Exchange Execution modes.

Use of fill policies depending on the execution type can exist shown equally the following tabular array:

| Type of Execution/Fill Policy | Make full or Kill | Firsthand or Abolish | Return |

|---|---|---|---|

| Instant Execution | + | — | — |

| Request Execution | + | — | — |

| Market Execution | + | + | + |

| Commutation Execution | + | + | + |

Source: https://www.metatrader5.com/en/terminal/help/trading/general_concept

0 Response to "How To Set Stop Loss On Metatrader 5"

Post a Comment